About Us

UFLA is at the forefront of designing and executing financial education programs that target youth, women, civil servants, families, smallholder farmers, religious institutions, SACCOs, and the informal sector. Our tailored financial literacy training programs encompass nine key modules: Growth Mindset, Personal Financial Management, Saving, Investment, Insurance, Debt Management, Retirement Planning, Digital Financial Literacy, and Understanding Supervised Financial Institutions. These modules are critical for promoting financial literacy for wealth creation, personal finance skills, and responsible financial decision-making

Background

The Uganda Financial Literacy Association (UFLA) is the peak umbrella body promoting quality financial education and literacy in Uganda. As a non-profit organization headquartered in Kampala, UFLA serves as a hub for financial literacy trainers, thought leaders, institutions, and stakeholders committed to elevating financial literacy in Uganda. With over 2,400 trained and certified financial literacy professionals, UFLA is a key player in implementing the Strategy for Financial Literacy in Uganda (2019–2024) and the National Financial Inclusion Strategy (2023–2028).

With over 2,400 trained and certified financial literacy professionals, UFLA is a key player in implementing the Strategy for Financial Literacy in Uganda (2019–2024) and the National Financial Inclusion Strategy (2023–2028).

MISSION

" Foster the promotion financial literacy through appropriate training and coordination of Financial Literacy activities"

- Become a Member of UFLA

- Support Financial Literacy, Transform Lives

- Explore. Learn. Grow.

Strategic Pillars

Our work is grounded in five strategic pillars outlined in the UFLA Strategic Plan 2024–2027:

- Mobilization and Support of Financial Literacy Training

- Research and Development of Financial Literacy Content

- Monitoring and Evaluation of Financial Literacy Activities

- Policy Support and Advocacy

- Institutional Strengthening and Capacity Development

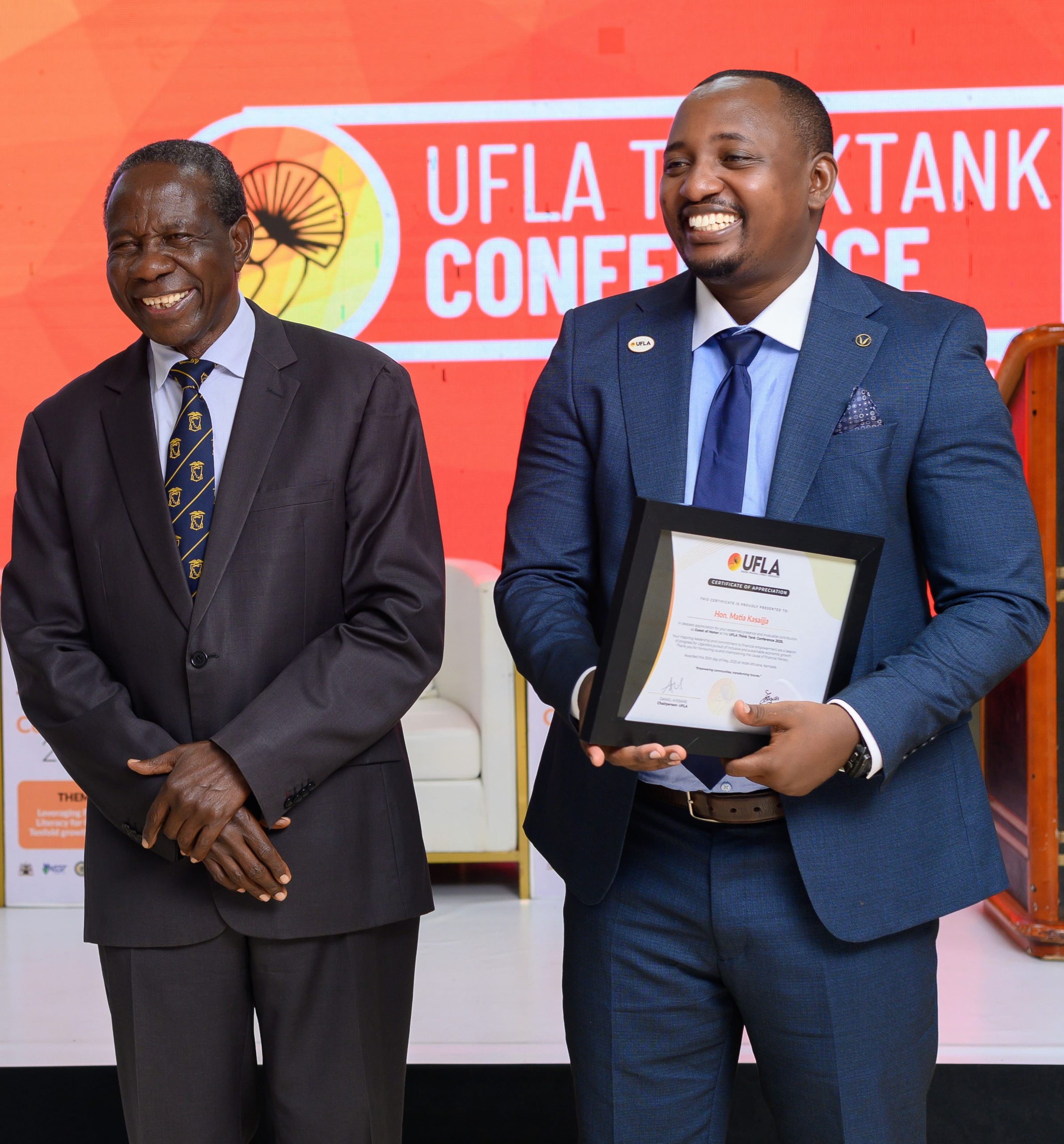

Through these pillars, UFLA collaborates with government agencies, commercial banks, microfinance institutions, SACCOs, insurance companies, academia, and development partners to foster a financially literate society. We host an Annual Financial Literacy Think Tank Conference, bringing together seasoned financial literacy trainers, regulators, and innovators to co-create new content and assess the impact of financial education in Uganda.

Membership

Membership

UGFINLIT App

UGFINLIT App

Projects & Initiatives

Projects & Initiatives

Research & Resources

Research & Resources

How do you break through your target market?

Congratulations Edton Babu and Nshuti Elve .

Upcoming Events

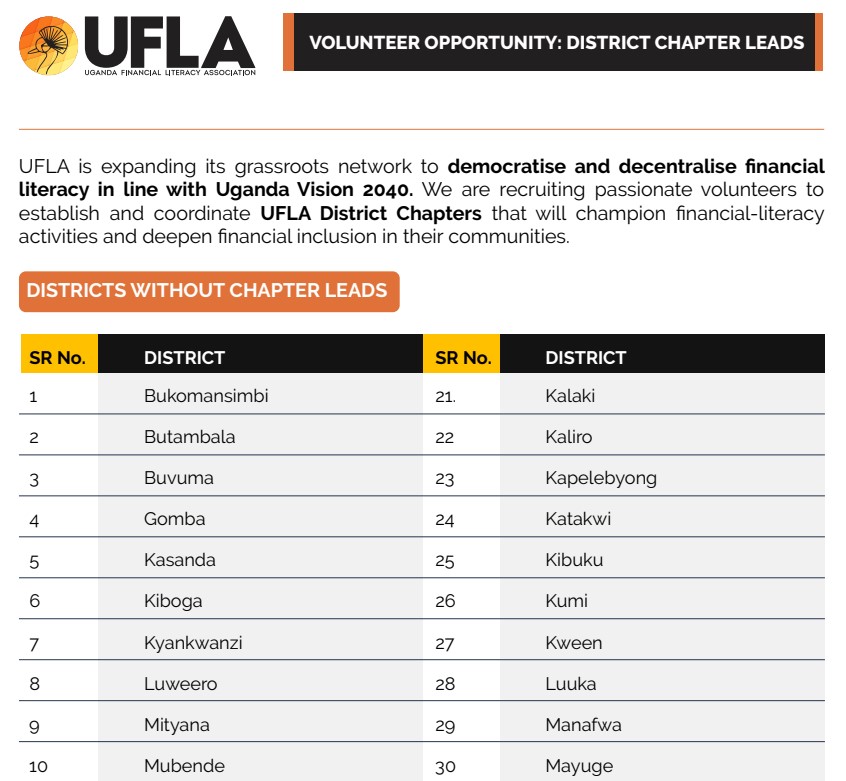

VOLUNTEER OPPORTUNITY: DISTRICT CHAPTER LEADS

UFLA is expanding its grassroots network to democratise and decentralise financial literacy in line with Uganda Vision 2040. We are recruiting passionate volunteers to establish and coordinate UFLA District Chapters that will champion financial- literacy activities and deepen financial inclusion in their communities.

What You Will Do

- Mobilise local stakeholders and members.

- Coordinate training, awareness drives, and community events.

- Report progress and impact to UFLA’s national secretariat.

- Advise on local financial-literacy needs and opportunities.

Our Partner's

As a partner of both the Bank of Uganda (BoU) and the Ministry of Finance, Planning, and Economic Development (MoFPED), UFLA plays an integral role in policy advocacy, research, and the monitoring and evaluation of financial literacy initiatives