"Our mission is to foster the promotion financial literacy through appropriate training and coordination of Financial Literacy activities".

UFLA is at the forefront of designing and executing financial education programs that target youth, women, civil servants, families, smallholder farmers, religious institutions, SACCOs, and the informal sector. Our tailored financial literacy training programs encompass nine key modules: Growth Mindset, Personal Financial Management, Saving, Investment, Insurance, Debt Management, Retirement Planning, Digital Financial Literacy, and Understanding Supervised Financial Institutions. These modules are critical for promoting financial literacy for wealth creation, personal finance skills, and responsible financial decision-making.

Uganda Financial Literacy Association

Championing Financial Literacy in Uganda for Sustainable Economic Empowerment

The Uganda Financial Literacy Association (UFLA) is the peak umbrella body promoting quality financial education and literacy in Uganda. As a non-profit organization headquartered in Kampala, UFLA serves as a hub for financial literacy trainers, thought leaders, institutions, and stakeholders committed to elevating financial literacy in Uganda. With over 2,400 trained and certified financial literacy professionals, UFLA is a key player in implementing the Strategy for Financial Literacy in Uganda (2019–2024) and the National Financial Inclusion Strategy (2023–2028).

Our flagship initiative, Project Take UFLA Home, is an ambitious 3-year program designed to decentralize financial literacy by establishing UFLA chapters in all 146 districts of Uganda. This community-driven approach ensures financial literacy reaches the last mile, especially in rural and underserved communities, where access to formal financial services is limited. With regional hubs in Northern, Eastern, Western, and Central Uganda, and a growing pool of over 330 district-based volunteers, UFLA is democratizing access to financial education through district-based workshops, community-based training, and mentorship programs.

As a partner of both the Bank of Uganda (BoU) and the Ministry of Finance, Planning, and Economic Development (MoFPED), UFLA plays an integral role in policy advocacy, research, and the monitoring and evaluation of financial literacy initiatives. We are a trusted technical partner in the implementation of key national programs, including the Parish Development Model (PDM), where UFLA contributes by developing customized financial literacy content aligned with Uganda’s socio-economic development agenda.

Our work is grounded in five strategic pillars outlined in the UFLA Strategic Plan 2024–2027:

Mobilization and Support of Financial Literacy Training

Research and Development of Financial Literacy Content

Monitoring and Evaluation of Financial Literacy Activities

Policy Support and Advocacy

Institutional Strengthening and Capacity Development

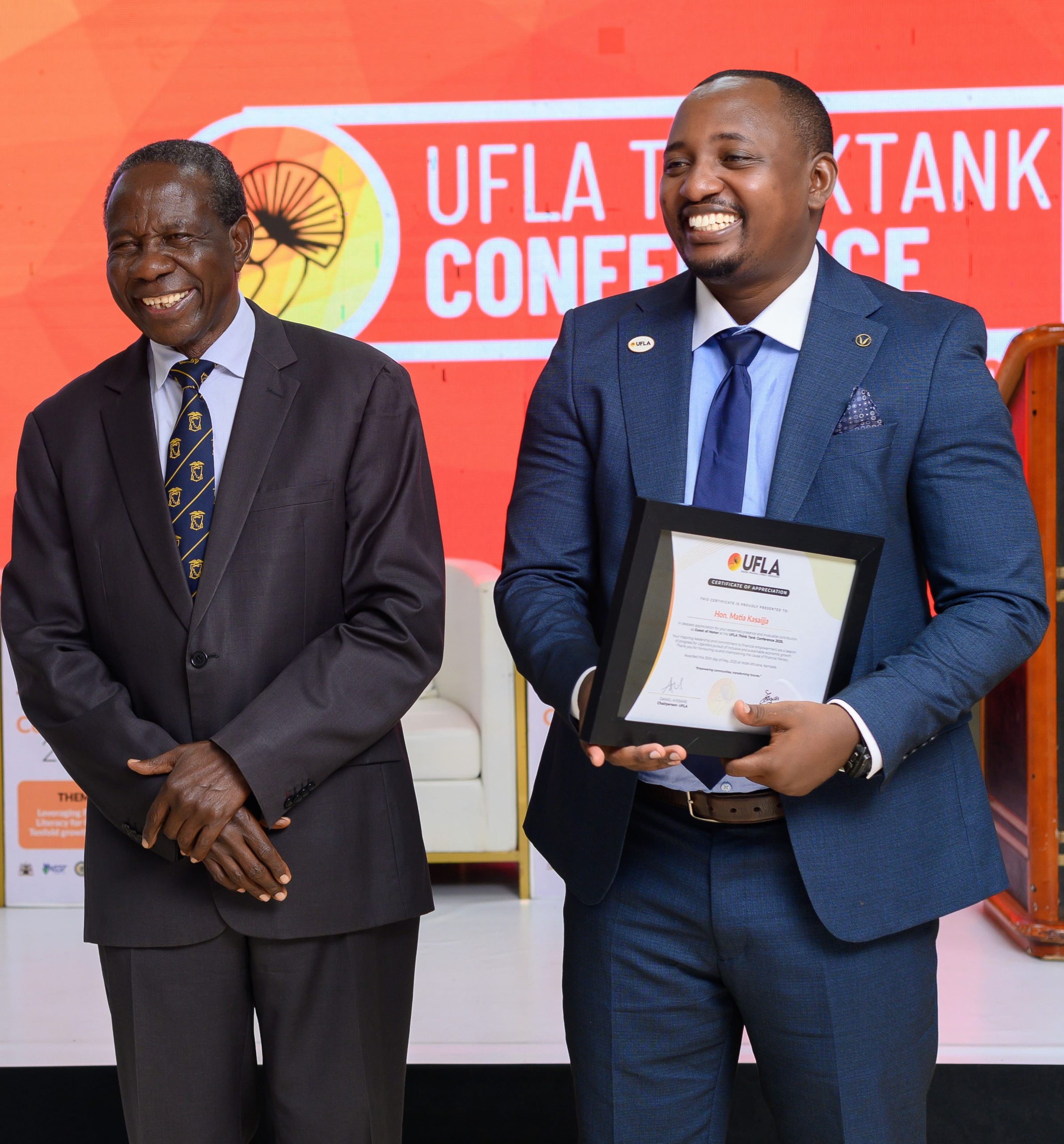

Through these pillars, UFLA collaborates with government agencies, commercial banks, microfinance institutions, SACCOs, insurance companies, academia, and development partners to foster a financially literate society. We host an Annual Financial Literacy Think Tank Conference, bringing together seasoned financial literacy trainers, regulators, and innovators to co-create new content and assess the impact of financial education in Uganda.

To ensure inclusivity, UFLA is translating its curriculum into eight local languages, making it accessible to diverse populations. Moreover, we are investing in digital financial services through our mobile platform, the UGFINLIT App, which will offer self-registration, member profiling, chatbot services, online financial literacy modules, and real-time M&E tools for institutional and individual reporting.

Our vision to become the RAREst association in Uganda — Richest, Accommodating, Regional, and Empowering — guides our expansion and innovation. UFLA is more than just a network of trainers; it is a movement for socio-economic transformation, aiming to produce a generation of Certified Financial Advisors (CFAs) and thought leaders who can influence policies, improve financial habits, and create wealth at both individual and national levels.

As financial inclusion remains a national priority, financial literacy becomes an essential lever for equipping Ugandans with the tools to navigate complex financial landscapes, avoid predatory financial products, and build long-term resilience. Our curriculum not only covers practical concepts like budgeting, saving, investing, insurance, and debt management, but also addresses emerging trends such as digital banking, mobile money, cybersecurity, and financial scams awareness — ensuring that every Ugandan is digitally and financially empowered.

Whether you’re searching for financial literacy training in Kampala, looking to become a financial literacy trainer in Uganda, or want to partner with a financial education NGO, UFLA is your ideal partner. Our programs are suitable for schools, universities, civil society, Banking and Financial Institutions, faith-based institutions, local governments, businesses, and households.

If you are a development partner, policy maker, private sector actor, or simply a citizen passionate about financial empowerment, we invite you to join the Uganda Financial Literacy Association. Let’s build a financially informed Uganda where everyone, regardless of their socio-economic background, has the knowledge and confidence to make sound financial choices.

Financial literacy as the missing link in poverty alleviation | MORNING AT NTV

Donate: - Support Financial Literacy, Transform Lives

Your donation fuels life-changing financial education programs across Uganda. Every contribution big or small helps train more trainers, reach underserved communities, and equip citizens with essential knowledge to thrive.